‘The Rent Eats First’: How Renters and Communities are Impacted by Today’s Housing Market

Written Testimony before the

U.S. Senate Committee on Banking, Housing, and Urban Affairs

Hearing on:

‘The Rent Eats First’: How Renters and Communities are Impacted by Today’s Housing Market

August 2, 2022

Laura N. Brunner

President & CEO, The Port of Greater Cincinnati Development Authority

The Port’s CARE Homes initiative is a critical intervention that disrupts institutional investors’ constraints on local families and properties. The purchase of this portfolio protects renters from the threat of rising rent prices while offering them a pathway to homeownership.

Chairman Brown, Ranking Member Toomey, Members of the Committee on Banking, Housing, and Urban Affairs: thank you for the opportunity to testify today on how renters and communities are impacted by today’s housing market and how institutional investors are changing the landscape of single-family housing in Hamilton County.

My name is Laura Brunner, CEO and President of The Port of Greater Cincinnati Development Authority. The Port is a public, quasi-governmental agency focused on mending broken real estate to promote job creation, homeownership, and equitable development throughout Hamilton County. Our work is guided by the belief that real estate should work for everyone.

With tools, resources, and experience, The Port is in a unique position to pioneer diverse models of real estate equity, developing innovative solutions to complex issues. Our Public Finance Practice acts as a financing conduit, offering resources such as the issuance of tax-exempt debt, Property Assessed Clean Energy bonds, tax increment financing, among others, to further stimulate private investment in commercial real estate and fund critical economic development efforts across the region. Through our Driving Real Estate to Accelerate Microenterprise (DREAM) Loan fund, we’ve infused much-needed capital to projects in disinvested neighborhood business districts and minimized barriers for neighborhood microenterprise and entrepreneurs. The Port’s Communities First Down Payment Assistance program offers down payment and closing cost assistance grants to eligible homebuyers across the state.

Our Neighborhood team focuses on the acquisition and rehabilitation of blighted residential and commercial properties to provide housing options across multiple price points from affordable to market-rate, resulting in the revitalization of neighborhoods and disinvested commercial districts. The Port operates the Hamilton County Landbank, whose mission is to return vacant properties back to productive use. In cooperation with our governmental and non-governmental partners, the Landbank facilitates the rehab and reutilization of vacant, abandoned, or tax-foreclosed real properties until end users are identified for highest and best use of these properties. Since 2012, we have successfully disposed of more than 1,000 properties.

The Homesteading & Urban Redevelopment Corporation (HURC) is another Port-operated entity dedicated to improving the quality of housing stock and increasing homeownership throughout the region. This program is primarily focused on income-qualified affordable homes and requires a significant amount of subsidy. With average sale prices for HURC homes ranging from $75,000 to $165,000, we are able to offer lower-cost options for buyers in low-to-moderate income areas. There is an estimated shortfall of 40,000 affordable housing units in Hamilton County and HURC is actively addressing this shortage by bringing much needed quality units online.1

The Port also leads a more targeted neighborhood real estate rehab initiative known as the Rehab Across Cincinnati & Hamilton County (REACH) program. REACH focuses on accelerating neighborhood reinvestment by acquiring and renovating pivotal blighted properties in target areas which have seen a long-term decline in housing value. It has a transformational impact on neighborhoods plagued with limited housing activity, creating new market comps and making communities attractive for future investment. Since 2015, The Port’s residential program has created more than 100 renovated and new market rate and affordable homes across the region.

Housing development is not simply a by-product of economic development; but rather, an engine of economic stability and growth. The Port recognizes that a sufficient supply of housing, affordable to households of all income, is the foundation for economic mobility and opportunity. Jobs provide financial stability, and homes create wealth. Real estate is one of the fastest ways to shrink the wealth gap and to help restore the middle class. In Cincinnati, Black homeownership is only 33%. Nationally, about 42% of Black households own their home, compared to 72% of white households, and “if the typical Black-owned home was worth the same as the typical white-owned home, Black wealth would more than double.”2 Housing and homeownership is the foundation of everything else in our lives, and for too long, the lingering legacy of redlining and segregation has stifled Black residents from the opportunity available to their White counterparts.

Homeownership remains an integral part of the American Dream. Owning a home is a symbol of financial success and a vehicle for accumulating wealth and building equity. However, the idea of the American Dream is even more so about opportunity and upward mobility. The reality is that not everyone wants to be a homeowner and not everyone has the means to purchase a home, but everyone should have access to a place to live and a pathway to homeownership. Locally, a recent report found that the Cincinnati metro area has more than 81,000 extremely low-income renters, but only 33,000 available units they can afford. Roughly 67% of the extremely low-income households are severely cost burdened and spend more than half of their income on rent.3 Access to affordable rentals and the ability to save enough money to purchase a home have become increasingly hard today, partly due to institutional investors infiltrating the housing market across the country.

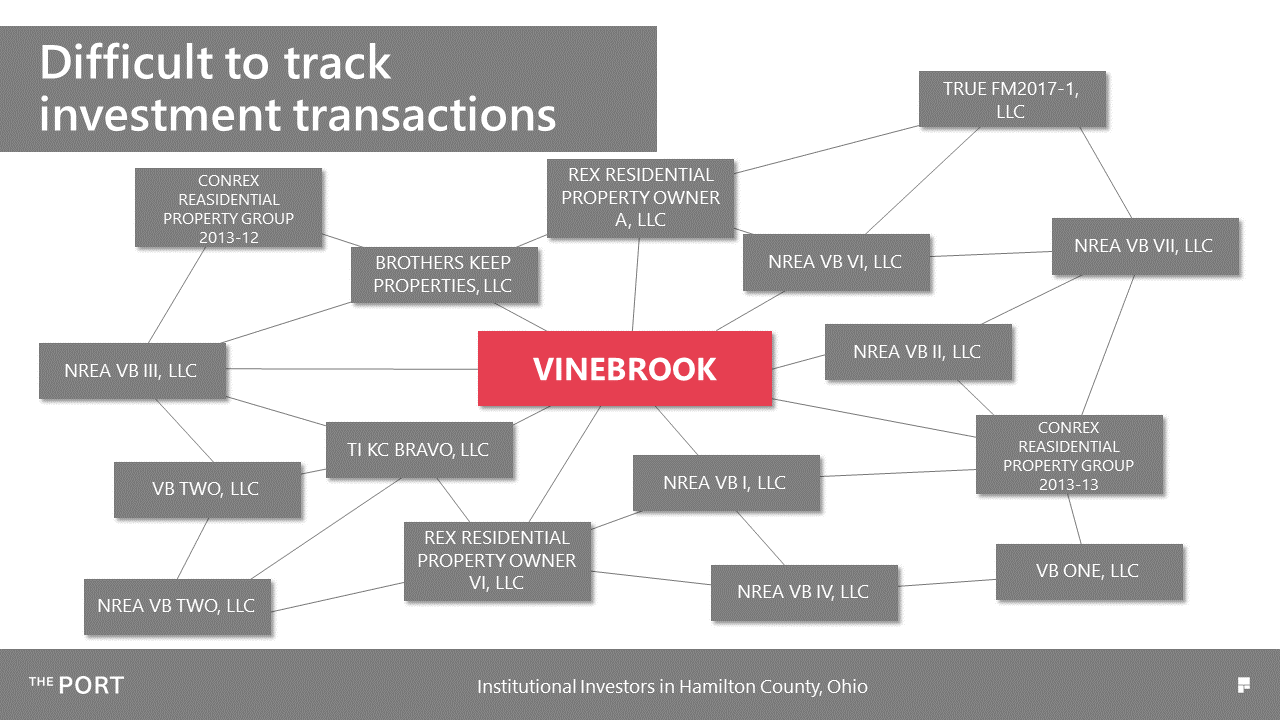

Our attention to investor activity in the local housing market came out of a conversation with the City of Cincinnati’s property maintenance division and quality of life team around code enforcement. We wanted to know who the worst landlords in the Cincinnati area were. It took months of rigorous research to uncover that over 4,000 single-family homes in Hamilton County had been purchased by just five institutional investors since 2013. Tracking the acquisitions was an arduous task and required review of numerous real estate transactions and auditor data in an effort to connect large corporate investors organized as Real Estate Investment Trusts (REITs) and LLCs to specific names. Property purchase price information was limited because of varying LLC names and a long list of transfers to themselves. Eventually, we were able to track consistencies in owner name and addresses on the Hamilton County Auditor’s website. Tracking this information was messy work, but it led us to the same five worst landlords identified in our initial conversation with the City. The results are sobering. Through our research, we uncovered over 90 different LLC’s affiliated with VineBrook Homes, the largest outside investor in the regional housing market. It became very clear that this ownership structure is based on the maximization of profit by hiding behind a cloak of anonymity.

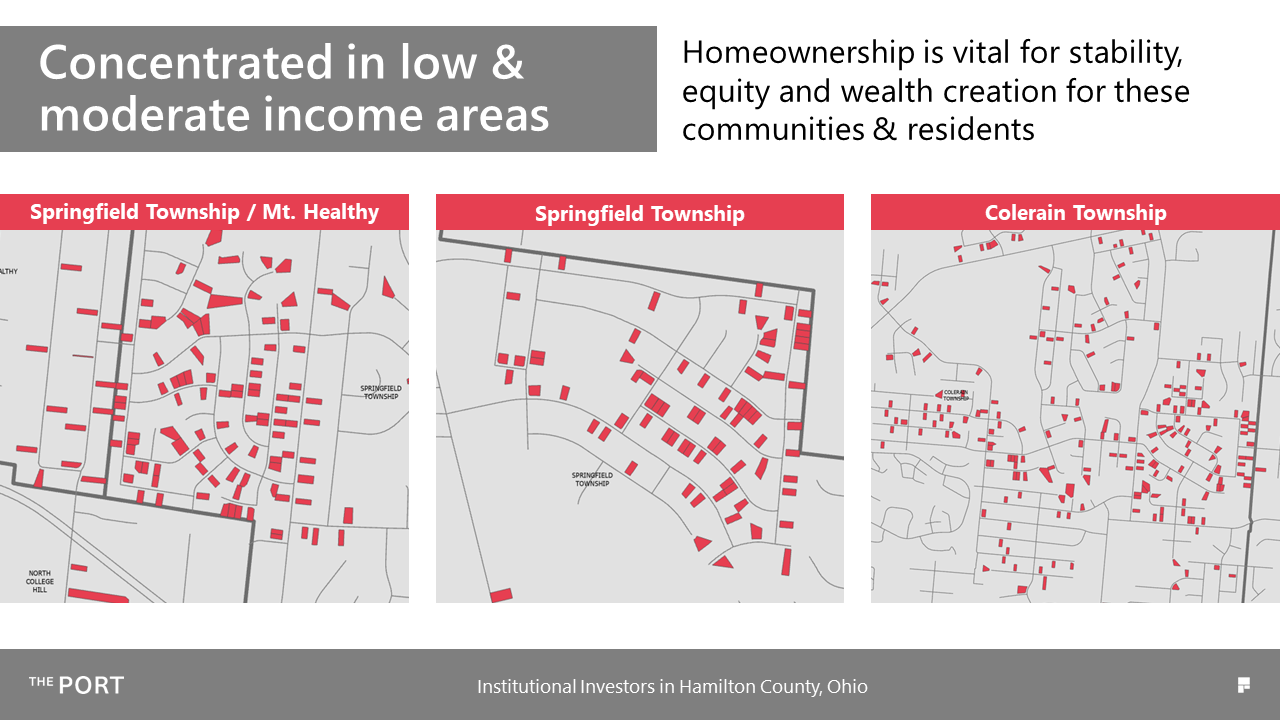

As evidenced by the City of Cincinnati’s lawsuit against VineBrook last year, the lack of transparency with this type of investor model results in poorly maintained properties and negligent landlord practices. The failure of an investor of this magnitude has harrowing consequences on a community. We’ve been told by institutional investors that they only own about 1% of single-family homes; however, in Hamilton County, this could mean 50% of the houses on a single street. When the geographical impact is so concentrated, it has a game-changing effect on what it means to live in that neighborhood. It has an impact on ownership, where more than half of the homes on one street are converted into rental properties. It has an impact on neighboring homes, where surrounding properties see a downward pressure on property values. It has an impact on the overall fabric of a community. This model is opportunistic, not strategic, and it’s happening at the expense of the most vulnerable members of our society.

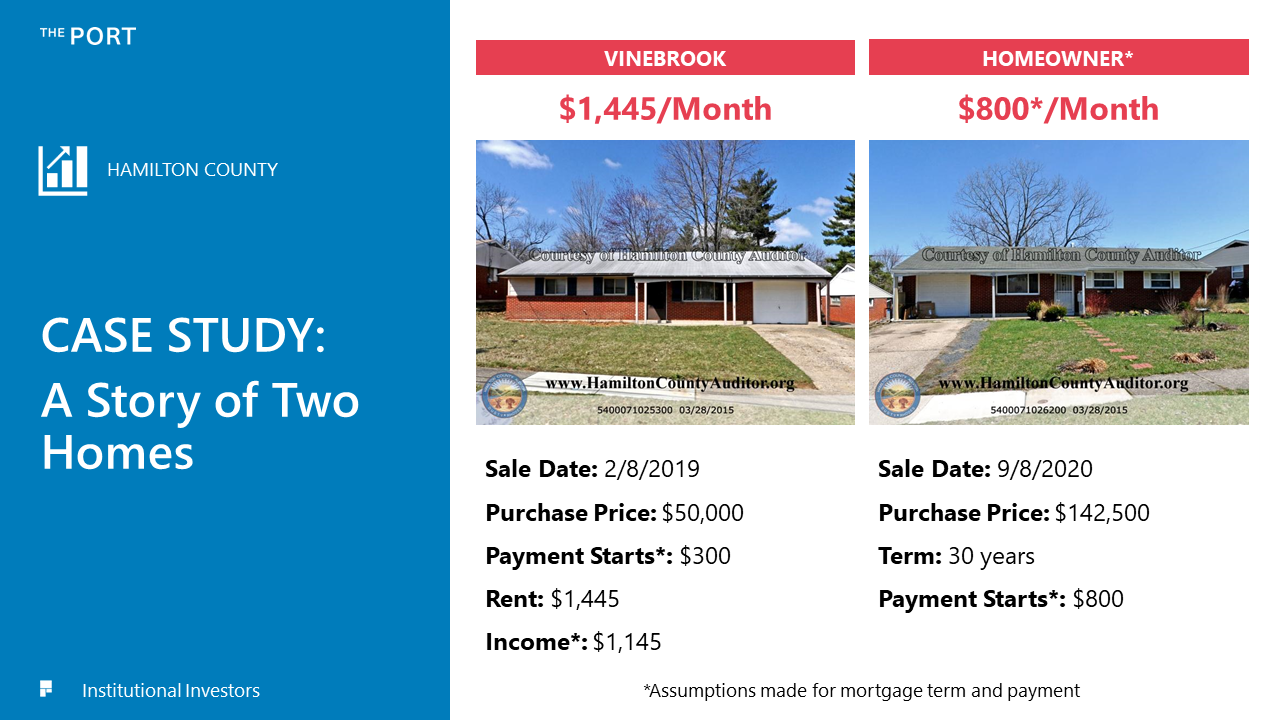

Since the foreclosure crisis of 2008, institutional investors have been purchasing large volumes of single-family homes in the region and turning them into high-priced rental properties. What we found in our research is that they typically purchase homes in geographically targeted areas, usually the region’s most disinvested neighborhoods. They make all-cash offers for the properties and box out first-time and lower-income buyers. Our low home values and high rental market make these properties attractive. It’s a cash cow for investors but a money pit for renters.

Institutional investors found a very profitable new sector. They claim to be responding to existing demand and limited supply. Yes, demand may be high, and supply may be limited, but in the Cincinnati region, these investors are not building new homes or expanding options. They are switching homeowner properties to rental properties and hiking up rents. Studies have found that investor landlords are also more likely to evict their tenants and poorly maintain their properties.4 They are maximizing profits at the expense of vulnerable tenants and fundamentally changing the landscape of single-family housing in the region. In Q2 of 2021, one in six home sales were purchased by large investors, and we know that is significantly higher at price points below $250,000. Just last month, Cincinnati had the largest jump in rental prices in the country. Monthly rent for single-family homes in the area increased $267, or 23%, in the past year.5 These are the types of numbers that made it clear to us that it was our moral imperative to interrupt the cycle of investor activity in the local real estate market and make a radical change.

In December 2021, The Port placed a bid on 194 single-family homes formerly owned by a California-based firm that fell into receivership. Because of our public and private relationships, and the depth of our work in the region, Colliers International (a real estate broker with offices in Cincinnati and the receiver of this portfolio) reached out to The Port looking to sell. We couldn’t help but see this opportunity as the antidote to the threat. Purchasing the portfolio could chart a new path back to homeownership for these families and properties. In late January 2022, The Port closed on this acquisition and launched the Creating Affordable Real Estate (CARE) Homes Initiative.

To our knowledge, no other institution has ever taken on a project similar in scope and challenge to this purchase. It is a high-risk acquisition; but because of our risk tolerance, we were able to create an innovative financing model that included no public subsidy. The Port leveraged its nontax revenue to issue taxable and tax-exempt bonds to pay $14.5 million to acquire the portfolio of homes, outbidding over a dozen investment firms. An Ohio-based investor purchased the bonds issued to provide the financing to purchase the properties.

The Port’s intent with the CARE Homes initiative is to create viable pathways to homeownership for current rental tenants of these homes. The properties purchased in our portfolio are predominantly located in low-income disinvested census tracts. Data shows that in Hamilton County, Ohio, the median household income in 2019 was just over $57,000 annually. In the City of Cincinnati, the median household income was a little over $42,000 annually. As a result of corporate ownership, many of the residents of the CARE Homes portfolio have had minimal opportunity to accumulate wealth through equity. Changing that narrative is the driving force behind what we are doing. Through financial and homeownership training, we believe we can create a sea change in our neighborhoods when it comes to transitioning from renting to homeownership. This program is about longevity and building communities rich in opportunity for local families.

For this initiative to be successful, we knew we had to leverage strong community partnerships. As a result, we formed the CARE Homes Advisory Group, a diverse group of local nonprofit partners and housing advocates, including: The Legal Aid Society of Greater Cincinnati, the Community Action Agency, Metropolitan Area Religious Coalition of Cincinnati (MARCC), Housing Opportunities Made Equal (HOME), the Homeownership Center of Greater Cincinnati, Working in Neighborhoods (WIN), Talbert House, Price Hill Will, Sisters of Charity, Santa Maria Community Services, the Local Initiatives Support Corporation (LISC), and the Cincinnati Metropolitan Housing Authority (CMHA.) Each of these organizations play an important role in navigating the complexities of this initiative.

Our collaborative approach led us to partner with a local, HUD-certified homebuyer training nonprofit. Working in Neighborhoods (WIN) will provide assessment, financial literacy training, and homebuyer education for all interested tenants to best position them for stability and wealth creation as they take the step to buy their homes. WIN trains more than 300 families per year through its homeownership program and has achieved a 95% retention rate of their participant’s ability to close on and maintain their homes. In addition, more than 10,000 residents have sought out WIN for their homeownership assistance, creating a pipeline of future home buyers. They truly are an ideal partner for this mission.

Of course, bold ideas rarely come without big challenges. We quickly learned that the reality of the portfolio of homes posed difficult financial, operational, and physical challenges. As we continue to evaluate the condition of each home, early indications show a considerable amount of work needed to stabilize and improve several of these properties. Many have code violations and necessary maintenance that were left unaddressed and deferred when purchased by the previous investor. It’s clear that some of these homes have not been touched or upgraded since they were built in the 1950s. Furthermore, our portfolio is debt financed and operates without public subsidy, meaning limited access to flexible cash and no financial cushion to rely on. Balancing the financial performance needs of the homes with the human needs of tenants struggling with increasing costs of living is extremely challenging. This reality reinforces the significance of the portfolio purchase and The Port’s efforts to interrupt the cycle of investor ownership of these properties. It is clear that when an investor squeezes a single-family house for profit, the community is left holding the bag.

The question then becomes, “Can this model be replicated?” Our answer to that question is yes. It can, and it should; but it is not to be taken lightly. Taking on high-risk projects with high-interest debt rather than grant funds isn’t easy. It can be replicated when there are entities and organizations that can merge private sector speed with public sector mission-based approaches. Larger development financers perceive our CARE Homes financing model as a type of Environmental, Social, Governance (ESG) bond, a quickly growing area of the bond market. We know there is a way to leverage the growing interest for ESG to do similar initiatives in other markets.

The Port’s CARE Homes initiative is a critical intervention that disrupts institutional investors’ constraints on local families and properties. The purchase of this portfolio protects renters from the threat of rising rent prices while offering them a pathway to homeownership. As we navigate the complexities of our new initiative, it is clear that much more work is needed to combat the impact of predatory housing practices of institutional investors. Now, more than ever, bold policies and leaders are needed to ensure the housing market meets the needs of its community. Housing is a basic human need, and we strongly believe that everyone deserves the right to live in a decent and safe home. The Port has worked diligently over the years to restore neighborhoods and communities to places of opportunity. By adding to our housing supply and putting properties back to productive use, we’ve been able to provide housing affordability and ownership opportunities to residents and drive lasting change in our region. Investor activity in the single-family housing market poses a direct threat to the revitalization and growth of our neighborhoods – the change we worked so hard to build over the years. When presented with the opportunity to buy the CARE Homes portfolio, we did not hesitate. We knew it was our duty to play a part and make real estate work for our community, particularly our most vulnerable residents.

Chairman Brown, Ranking Member Toomey, and members of the Committee, thank you again for the opportunity to testify before you today. I look forward to your questions.